Payday advances will be in the headlines within the last week and commonplace in conversation on the list of MN Bankruptcy Attorneys at Kain & Scott. The customer Financial Protection Bureau has arrived away with a proposition to focus on pay day loan loan providers that trap consumers in longterm financial obligation. Payday advances are short-term, high interest loans frequently for under $500 bucks which can be reimbursed along with your next paycheck. As internet lending that is payday expanded therefore have actually the attention prices and costs. we frequently utilize consumers who possess gotten in to the period of payday financing.

CFPB Proposals

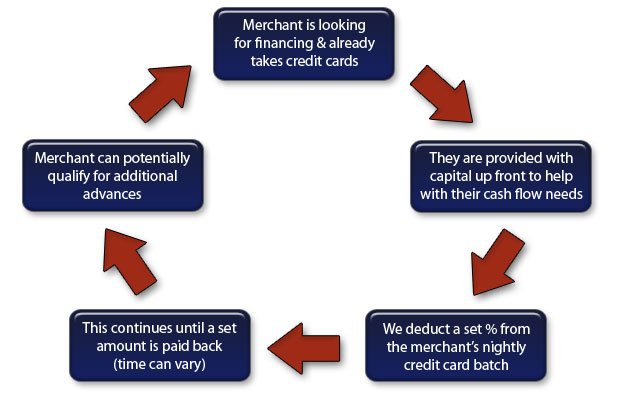

The CFPB proposals would expand customer protections to term that is short such a pay day loans and car name loans. Brief terms loans tout on their own as an instant one time method to get money before the next payday. Rather, the reality is that it could be a never ever ending period of payday loans with a high costs and greater rates of interest, about the average yearly price of 390%.

Here is the situation because many individuals applying for pay day loans are low income, don’t work a salaried place with guaranteed hours, consequently they are frequently behind on big bills such as for instance lease and resources. With pay fluctuating from paycheck to paycheck, by the next pay duration, the loan can’t be compensated using what is within the bank and another pay day loan is reissued. This begins the period leading up to a longterm financial obligation issue.

The proposals would stop the lender from having your banking account information to be able to immediately draw out of the repayment on payday. One good way  to sink further into financial obligation is to obtain stuck with NSF charges from your own bank if the payday loan provider would go to gather and there’sn’t sufficient cash in the lender to pay for them. Therefore so now your debt regarding the defaulted pay day loan as well as on NSF charges to your bank that may commonly be over $100 a pop music.

to sink further into financial obligation is to obtain stuck with NSF charges from your own bank if the payday loan provider would go to gather and there’sn’t sufficient cash in the lender to pay for them. Therefore so now your debt regarding the defaulted pay day loan as well as on NSF charges to your bank that may commonly be over $100 a pop music.

The lender would be required by the proposals to accomplish more research in the applicant to be sure the applicant could meet with the loan responsibilities without compromising their monetary future. At this time it really is unusual to own your credit file went whenever an online payday loan is released. The proposition would need that the applicant are able to spend the total loan quantity by the next pay duration.

Cash Advance Statistics

Because it appears about 80% of pay day loans are reissued in the thirty days. An average of it requires six months to leave of this pay day loan cycle with on average $520 in just charges compensated to your loan provider. This might be for a loan many people think are going to be paid down inside their next payday. The proposals would restrict anybody wanting to remove significantly more than one cash advance in a 30 time period day.

The proposals are in the early stages with nothing set to protect consumers from payday lending at this point. Minnesota falls at concerning the center regarding the road with regards to state laws regarding the pay day loan industry.

Payday advances in Minnesota

Be particularly careful with loans located on the internet. Online lenders that are payday the essential problematic with concealed costs and greater rates of interest than Minnesota legislation permits. They frequently you will need to evade state law through getting certified an additional continuing state with lax guidelines or perhaps not getting certified after all. In Minnesota the payday loan provider must certanly be registered to complete business in Minnesota. Ensure that the charges and rate of interest from the loans usually do not surpass the allowable costs and prices under Minnesota legislation. A chart is had by the Attorney General’s office, bought at the web link above that outlines the caps. Irrespective of where the world-wide-web loan provider is from or registered doing business, so long as you are really a resident of Minnesota, Minnesota legislation pertains to the net loan provider.

Ideally later on there clearly was greater legislation in this region to stop a little onetime loan from ballooning in to a big financial obligation problem. Until then though bankruptcy could possibly be a remedy to a cash advance problem, particularly when there are various other kinds of financial obligation also to manage such as for example credit debt. Pay day loan financial obligation is just a financial obligation that may be contained in either a Chapter 7 Bankruptcy or a Chapter 13 Bankruptcy filing. Perhaps the financial obligation continues to be utilizing the initial payday loan provider or if it is visited collections of a good judgment, your debt could be a part of a bankruptcy and discharged.

Near you to find out more whether a bankruptcy might be right for your situation if you are struggling with the cycle of payday loans and would like to discuss your options please feel free to contact one of our MN Bankruptcy Attorneys.